People often call us when there has been a loss at their home or with their cars and want to know if they should file a claim. They want to know if it’s covered and they want to know if it will make their rates go up. While both of these questions are good ones, the ultimate decision whether to file a claim is up to each customer and there is no way for us to know what a claim will do to someone’s rate. We can take a good guess, though.

In the insurance world, whether or not something is covered is often black and white, but sometimes it’s gray. There is a lot of “it depends” in the insurance world, and we, as agents, can only tell you what we’ve seen and heard. Every customer and every claim is different, which is why it’s important to read your policy to understand your coverage. The only way to get a 100% answer is to file a claim and find out, but sometimes, by then, it’s too late. Once you file a claim, it’s on your record, even if nothing ends up getting paid. Why is that? We’ll talk about that more in a minute, but the word to remember here is frequency.

So then the question is raised about whether rates will go up from filing a claim. Again the answer is “it depends”. Rate decisions are based on a lot of things, including things out of your control like the auto reform deal that’s being figured out now, as well as economic and industry changes. Claims are something that can both be in and out of your control. The things that are in your control are things like how fast you drive, how much space you leave between your car and the car in front of you, how distracted you are (or aren’t) when you drive, as well as your pride of ownership in your home or recreational toys, and the regular maintenance you do (or don’t do) on your home. We like to say “control the things you can control”. So drive at safe speeds, don’t be distracted, and take care of your home and the frequency (there’s that word again) of your claims should go down. Then there are things you can’t control, like deer jumping out in front of you, or other crazy drivers, or tornadoes or strong winds. Those are types of things that can cause claims just the same. And those types of claims could be more severe, our other key word.

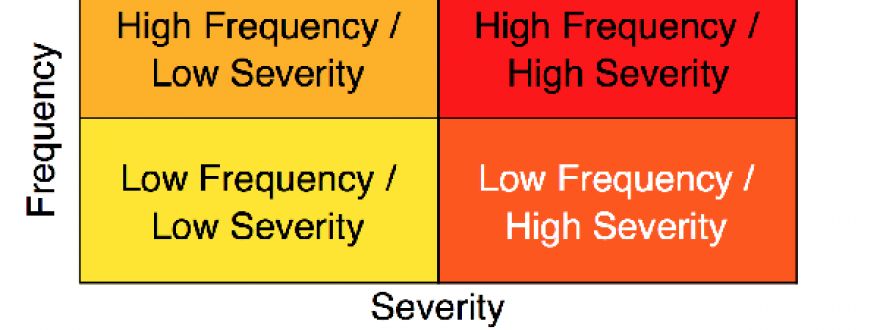

Frequency and severity of claims are two of the things that insurance carriers look at when determining a customer’s rates. How often do you file claims? And how much is paid out when you do file? Imagine two scenarios, if you will:

- Scenario A is a customer who never files claims. She is a safe driver and takes good care of her home. One day she’s driving and out of nowhere a drunk driver strikes her car in an intersection causing tens of thousands of dollars worth of damage to her car and herself.

- Scenario B is a customer who files claims frequently. Their car breaks down all the time and they call for towing every other month. They have a fender bender every couple years that pays out a couple thousand dollars each time. They don’t take great care of their home and their roof is leaking. Eventually a roof leak gets bad and they call a claim in, only to have the claim denied because it’s a maintenance issue.

In Scenario A, you have someone with low frequency but high severity. In Scenario B, you have someone with high frequency and low severity. In both cases, the carrier has some decisions to make about how to rate these people and charge accordingly for their risk. From our experience, people who file claims more frequently end up getting charged the most for their insurance. The insurance carrier is constantly “on edge” wondering not if, but when that person is going to file their next claim. The insurance carrier is anticipating something bad is coming, because something bad always happens to this person, and in turn the carrier charges more to try to mitigate that impending risk. When a person rarely files a claim, though, and they just have one really bad claim, we find that carriers still make pretty big adjustments to pricing. In this case, they have paid out a lot of money and they want it back. Yes, that’s what insurance is for, but insurance carriers don’t like risk any more than customers do, and so they price accordingly.

The best thing you can do to avoid price increases from claims is to avoid them in the first place. Drive safe and take care of your home. But if something bad does end up happening and you are considering filing a claim, consider the words ‘frequency’ and ‘severity’ in your decision. You know your behavior and your history better than anyone and you know if you file claims frequently or if the payouts are high or ‘severe’. If you are a frequent claim filer or your claims are severe, you may want to reconsider not only your decision to file a claim, but what keeps getting you there in the first place. Safer driving and regular home maintenance are things that will help both your frequency and severity and will keep your rates as low as possible.

Have questions about this or anything else? Call us at (248) 531-8300. We’re happy to help!

Levin Insurance Agency – Many Options, One Choice